Fintech scene in Switzerland – Is there a Brand Swiss?

In the 1949 classic movie, The Third Man, the central character famously says, “In Switzerland, they had brotherly love, they had five hundred years of democracy and peace. And what did that produce? The cuckoo clock.” Although the actor Orson Welles was later corrected (cuckoo clocks being created in Germany), the essence was that Switzerland is somewhat… shall we say, dull? Over the years the country, if anything, has capitalized on this, making precision, discretion and security watchwords for ‘Brand Swiss’.

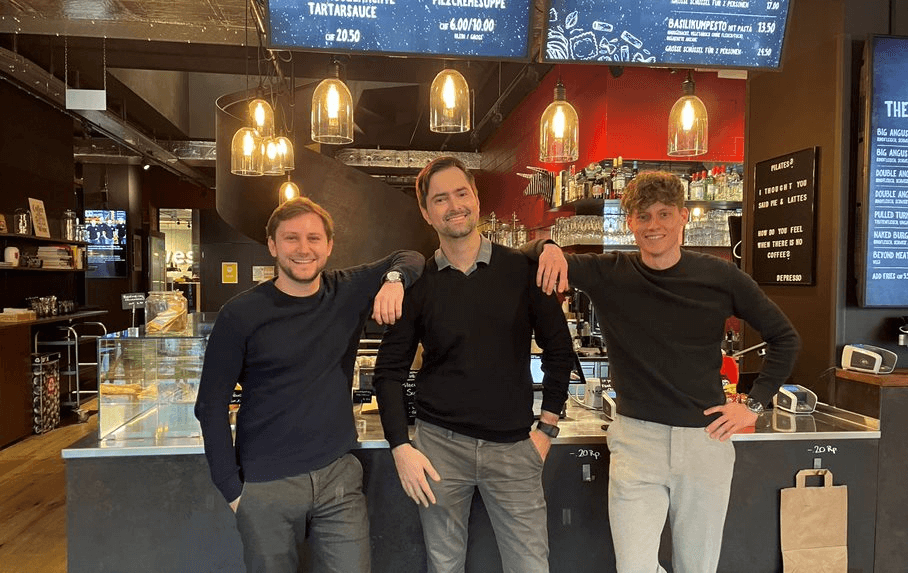

So is this image true? The three Swiss-ish Fintechers I meet up with are either atypical, or their very international base means that the cuckoo clock slur is way off-mark.

The energy bomb

Let’s begin with Peach Zwyssig, whose LinkedIn profile credits him as being a ‘positive energy bomb.’ That’s something I can agree with after a short time spent chatting with him. He’s Co-Founder, Board Member & CEO at Tech Venture Builder Axelra, and in various different profiles you’ll also see him named as the more conventional-sounding ‘Peter’. But why ‘Peach’? Well, it’s more or less the phonetic rendering of the Swiss shortening of the name Peter, but long ago when he was working abroad for Accenture, colleagues were unable to manage the pronunciation, which sounded like the less-attractive ‘Pitch’. So Peach he became, and has stayed. Perhaps it’s also a fitting nickname for a keen cook who runs a gourmet club with friends, and has his own food blog (although he admits to a few years of neglect, as Axelra has ramped up). Anyway, let’s talk about the company which says it will deliver MVP team revenues within 100 days.

“It’s a fantastic number,” Peach says. “In my former job, I created the strategy fit in 100 days. That’s a digitalization strategy for everybody with a plan and roadmap and prototype. The product went really well, and was consumed by many large corporations.” However there was always the problem of realizing the numbers below the line, and delivering results quickly, which Peach says comes down to speed of execution. “What we found is that there is a beautiful sweet spot attached to the organizational bubble. If you take a normal organization, and you have this model within the organization, you can run the business, change the business, innovate in the business, and you have agile and you have a waterfall project, they’re all okay. But you have to deal with a lot of trust issues and existing structures. It’s much easier for a startup, which is outside this bubble, although new customers and sales are the challenge here.”

OK, I’m getting that as a general picture, but then what happens?

Skin in the game

Peach continues at full steam, “What we do is that we look for that specific overlap where you’re still part of the organization… a little bit. But you’re an own company, and you were formed by all the partners for a specific amount of time with a dedicated goal, and skin in the game alignment. So you work for less, you get some shares or take risk with corresponding project KPIs, you’re incentivized in a smart way. And then you can work entrepreneurially with some of the guys from the organization, and with some other new guys, to build that venture setup. Within that setup, you have the best of both worlds, with speed and trust – which I believe are the currency of the future. You have execution capability, you interlink to the organization – you have a sponsor – and you have a clear goal. But you also have the capability to just execute and do stuff, and that’s actually what it’s all about.”

So Axelra is supplying the methodology for other firms to accelerate their digital business models, for both corporates and startups: The process is direct, and comes in 4 essential steps:

- Generating and varying ideas by understanding customer needs, market trends and technological potential. OK, check that.

- The second phase comes with Testing of up to 5 use-cases, and the creation of mockups and prototypes to evaluate with real (or potential) customers.

- After that comes the building and launching of the Minimum Viable Product. This phase will also include support in recruiting key personnel.

- Then comes growth-hacking by boosting continuous iterations resulting in scaling.

And apparently this can all be achieved in 100 days?

Yes, for the first three steps, says Peach, “You need to find the first MVP that generates revenue that you can build within 100 days, and also find out if that market-product fit will work or not. We have corporations coming to us saying, ‘Hey, we have this brilliant idea, but we know we don’t have the entrepreneurial mindset and people to really work it through.”

Is it only for corporations who already have, as Peach puts it, ‘Skin in the game’?

No to coffee hipsters

Not necessarily, he says, but neither is Axelra looking for those two mythic guys in a garage who have a great idea and are needing free support, perhaps in exchange for future shares. “We’re not really interested in the coffee hipsters with the nice sunglasses and the Apple watch who have some great ideas and are bored with their job,” he says, somewhat dismissively. In dealing with startups, Axelra looks to partner with people who have some investment incoming. There also has to be a technology component to the offering: “We build digital products, either with blockchain components or with portable mobile sales, and disruptive business models… doing things in completely new ways.” The goal for startups especially is to enable them to stand on their own feet after those first 100 days of being immersed in the Axelra process. That doesn’t mean they are then cast adrift, and indeed Peach likens it to waves, especially in the beginning when there are a series of Sprints, with companies then returning to Axelra as they scale up and are increasingly successful.

Size and scaling

An example of the process is with Swype, the embedded ‘eSIM’ service which offers unlimited internet access for CHF20 per month (roughly the same cost in euro), with the website saying that it is ‘impossible to pay more’ for the service. That’s quite an offer. Peach recounts, “We first built and launched the MVP in 2019 with a couple of companies, Moflix, Yallo, and others, together in a network The Moflix team was then hired in parallel and we handed over to them. So right now (at the time of speaking in 2021) there are around 10 guys at Moflix. They started with zero, and now are scaling internationally.”

And speaking of the size of companies, what’s the headcount of Axelra? Peach is proud that, in comparison to the scale and scope of the projects they’ve helped launch, the Axelra operation is comparatively lean, with around 20 employees. He himself is very hands on and fully engaged in projects, not merely in a management role. The culture is one of execution, with an avoidance of ‘too many workshops’, and office politics are a definite no-no. Casual dress is the order of the day, and the Axelra team often shares meals together: “It’s super-easy to work for us, and access to information is based on a high level of non-hierarchical trust.” That includes everyone in the company knowing how much everyone else earns, and what their expenses are. There are also plans in the pipeline for employees to become investors in the firm, and to access investment in some of the startups they are helping. As Peach says, with characteristic enthusiasm, “So everybody sees, okay, this is cool. Really, really cool.”

Meet the builder

Peach Zwyssig is a Swiss Tech entrepreneur, but I mentioned ‘Swiss-ish’ interviewees, so let’s drop in to meet Dr. Guilherme Sperb Machado. Guil, as he’s known, is Brazilian by birth, with a dash of German on his mother’s side (‘That’s where the Sperb in my name comes from’). After gaining his M.Sc. in Brazil, he went on to Hewlett-Packard in Britain as an academic researcher, before settling some 13 years ago to continue his studies in Zurich, where he is still connected with the university as a mentor and guest researcher.

So is he an academic, an entrepreneur, or..?

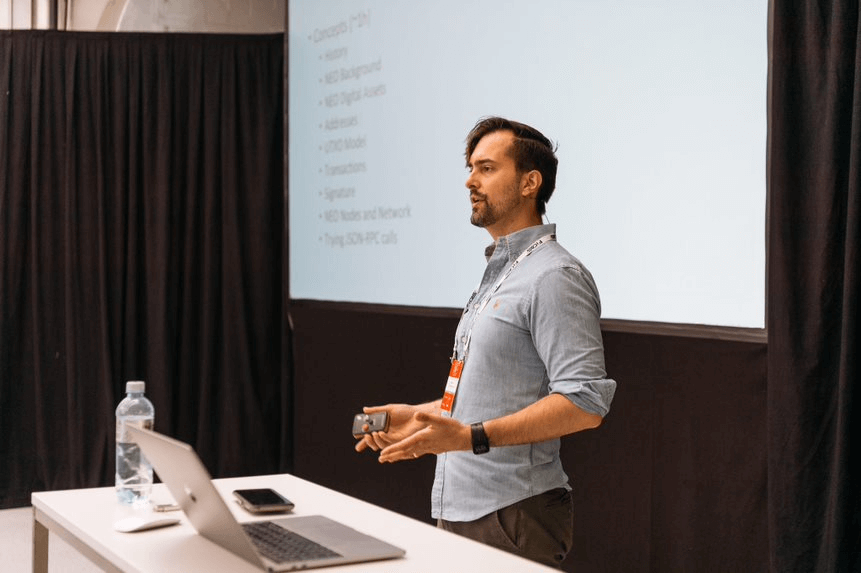

“I’m a builder,” he says. “I build things. Academics also build things. We build knowledge, and we spread knowledge among entrepreneurs. Also, we build solutions, companies, and projects. So I’m a tech builder, and a tech thinker. I say that on one side I’m an engineer building real solutions, but on the other side I’m also an entrepreneur because entrepreneurs take risks.” So let’s talk about the business Guil started, and is currently working in, AxLabs. Surely the name must have a connection to Axelra, Peach Zwyssig’s company? The answer is a Yes and a No. The two firms are related, and are ‘friends’, being part of the same ecosystem. But Guil says that the ‘Ax’ part of the names (and the fact that they have the same number of letters) is completely coincidental. What’s the story of AxLabs then?

Discussing crazy ideas

What brought Guil to Zurich was the opportunity to pursue his PhD, and during that time he became friends with a fellow student, Dr. Thomas Bocek, who went on to become a co-founder of Axelra. Back in 2013 however the two were interested in Bitcoin, and executed their first blockchain project. Guil says they were in the right place at the right time. “I was in Switzerland, an open country, doing a PhD in peer-to-peer networks and open protocols. We saw the potential of blockchain and Bitcoin, and we were part of these very technical discussions about peer-to-peer protocols and decentralization.”

All these years later, Thomas and Guil are still friends, ‘discussing crazy ideas’ over coffee at AxLabs or Axelra. They share their academic background, co-supervising Master and Bachelor theses for the University of Zurich. In addition, Guil also believes in ‘giving back’ to his native country and occasionally reviews Brazilian academic and conference papers, in Portuguese.

SIBEX was Guil’s initial tilt at the Fintech market, to provide, as the website outlines: ‘The first complete peer-to-peer decentralized OTC trading software that allows users to trade cryptocurrencies between blockchains with no third-party involvement. By providing an institutional-grade dark venue for digital asset procurement and liquidation, the platform solves issues such as front-running, and reduces the trading cost of capital. SIBEX works to make DeFi OTC trading safe, private, and simple.’

Helping with the growth of the company was Axelra, and initially Guil reports that the seed round was very successful. However, when the A-series came along, “Things got a bit more challenging.” Investors such as the Swiss stock exchange operator SIX group, Fenbushi Capital from China, and Silicon Valley’s Accomplice VC were all keen, and Guil stresses that, “We have intellectual property and a working product, but SIBEX is on pause and searching for alternatives.”

Enter AxLabs

Presumably this is where AxLabs entered the picture? But no, it’s not as linear as that – AxLabs was already in existence with its team of three (Guil, Claude Müller, and Michael Bucher), even before SIBEX was put on hold. Guil directs me to the recently revamped AxLabs website to see the company offering: ‘Bleeding-edge tech to build rock-solid products. We are a Swiss tech company specialized in software and infrastructure engineering for blockchain, open protocols, and decentralized solutions.’

That ‘rock-solid’ reference chimes with the perceived qualities I mentioned earlier, about Swiss reliability and security. This is a nation which stores vast wealth in – literally – rock-solid vaults in mountain retreats. Is that the meaning of ‘rock-solid’ for AxLabs?

“It’s very hard to translate innovation to products, something that people get to use on a daily basis, something that people will broadly consume.” Guil expands the thinking, “So that’s the spirit that we bring to AxLabs: We can use blockchain technology, zero knowledge proof techniques, decentralized protocols, and other rather complex innovative tech. But at the end of the day we have to provide solid products that users can rely on. What we do in concrete terms is, we take projects in the blockchain industry, not necessarily only Fintech-related, and we execute them. We add our touch to bring this in as a product. So we are a specialized company in blockchain engineering, and our team has decentralization and openness in their blood.”

The company was featured in a 2021 CV VC report about the top 50 leader/startups by sector in Crypto Valley – with AxLabs in the ‘Blockchain Technology Solution Providers’ category. The recognition is something that Guil is pleased to see, with AxLabs being mentioned alongside big names such as EY, PwC, Swisscom, and Inacta.

If others are successful, we will be successful

Does the team go out client-hunting, or do customers beat a path to their door? Currently, Guil says they are, “A bit spoiled. We search the niche that we want to be part of, and we submit proposals. We know what kind of projects are required within blockchain communities. Of course, we have to risk our time writing a proposal and Proof Of Concept to show that it’s possible. And we have to invest around 3 months making sure that the proposal is solid.” There’s that ‘solid’ description again.

He mentions companies such as Modum or Swisscom that have come looking for proprietary software. The payoff might be a maintenance contract, but in the last few years the AxLabs business model has changed as the company works more and more in open source software. An example of this is with the Neo Foundation, which has developers and community members all around the globe. Everything developed for Neo is open source, with the foundation offering grants for development. Guil admits that there is a possibility that if the software is ‘absurdly successful’ other companies or projects in the community could take it over, including the maintenance contract. But he shrugs, as if to say, ‘Those are just the risks we take.’

“So I know it’s not all roses, and happiness around – there are some challenges,” Guil summarizes his approach. Yes, sometimes AxLabs submits proposals that don’t get accepted, but openness is part of his vision for the future, which he believes will generate traction, and allow further projects to flow in. “If others are successful, we will be successful.”

File under..?

Let’s now check in with the most out-there Swiss Fintecher – in terms of his ‘Swiss-ness’ – Sean Murphy. His name might be an obvious giveaway, but in our globalized, Fintech world, who can say where someone comes from and which geographical area they might operate in? Sean is Irish, resident in Hungary… and his company is Swiss. ‘So can I file you under Swiss Fintech?’ I ask as we start our interview, and Sean answers in the affirmative. Well, with some caveats.

“Let me give you some background on Impactscope,” he starts. “The company is both a Swiss and an Estonian company. We have a nonprofit arm, which is registered in Geneva, and we have a commercial venture arm, which has its headquarters in Tallinn. I’m one of the co-founders, and the other co-founder is Gregg Betz, an American who – like me – has been resident in Hungary for several decades.” Sean adds that both he and Gregg ‘acquired’ Hungarian wives along the way, so they are well-settled in Budapest.

“The third founding shareholder is English, who’s also been here for a long time too – James Atkins, the chairman of Vertis environmental finance, one of the largest, best regarded emissions trading companies in Europe. Our team is growing fast. We have group companies in Hungary, Switzerland, and Estonia, and team members in England and Dubai. A lot of blockchain companies are setting up in the UAE,” says Sean. The tax regime is favorable for crypto companies, and there’s a positive regulatory licensing framework for crypto activities. It was in Dubai at the Gulf Blockchain Week in October 2021 that Impactscope managed the offsetting for what was the biggest global hybrid NFT online/offline auction.

Sustainability SaaS

So what does Impactscope do? I picked up on environmental finance and emissions trading, and while there are many Fintechs, and established banks showing commendable leanings towards environmental concerns, these seem to be add-ons. The Impactscope model sounds intriguing, as Sean continues: “We started out essentially as a Sustainability Software as a Service company. So our primary business model was to build carbon offsetting APIs, specifically for digital asset marketplaces, or other cryptocurrency exchanges. The exchanges take our APIs, plug them into their back ends, and that allows their clients to offset the carbon emissions of their crypto transactions in real time.”

It’s like the model many people are familiar with when they buy an airline ticket and are then offered a tickbox to add a few dollars to offset flight emissions. “We’re replicating that, but in a more captivating and engaging way, and specializing in cryptocurrency exchanges as our sales channel partners,” co-founder Gregg Betz explains. “There’s also a more direct side of the business where we deal with clients who are the cryptocurrency mining companies, blockchain enterprises, and institutional investors with crypto holdings. We help them calculate the exact size of their carbon footprint as it relates to their crypto activity. We address and formulate ESG (Environmental, Social, and Governance) reporting strategies around that. And of course, we also help them acquire offsets to that particular carbon footprint.”

Major integrations with crypto exchanges include YouHodler, a large crypto lending platform based in Switzerland. Crypto2Cash, a leading European crypto-to-cash provider has also signed up with Impactscope. Then there are significant carbon emissions calculation services lifecycle analyses for two large North American crypto mining companies, one of them being Arthur Mining, a fast-growing Bitcoin-mining operator with active sites and partnerships in South Carolina, Pennsylvania, Ohio and Indiana.

Oh, and Sean mentions an offsetting pipeline that Impactscope is developing internally for the Eastern Agricultural Development Company in Soroti, Uganda… and the championing of a Hungarian Inventor’s unique Direct Air Capture technology for carbon capture and sequestration, entered for the $100 million Musk Foundation carbon removal prize.

But hang on, is this all open to the accusation of ‘Greenwashing’? – The process where organizations might pay lip service to environmental concerns by claiming their offering is ‘good for the planet.’ Gregg Betz steps in to robustly answer my doubts.

Precise analysis of the carbon footprint

“No-one should perceive us as enabling greenwashing. In fact, nothing could be further from the truth. We’re working to prevent cryptocurrency companies from engaging in greenwashing. We’ve developed the tools to help the cryptocurrency exchanges and mining companies get a very precise idea of the carbon footprint they are directly and indirectly responsible for – from their business operations and from their onchain transactions. We identify high quality offsets, certified by Verra, or Gold Standard, so there are no issues like double spending, the integrity of projects, or the way projects are audited.”

Coming from a ‘first-mover position’ and running live from March 2021, Impactscope has witnessed rapid market entry by other offsetting service companies for the digital assets market segment. In response, the Impactscope offering was expanded by taking the existing business model of delivering offsets via the API, and tokenizing the service. Initially the confirmation of carbon offsets was done by PDF – not very blockchain – but soon the delivery mechanism will be entirely suited to token native companies.

That was step one, but step two was to establish the company’s presence in Estonia – which has very proactive crypto and blockchain regulations – and to build Impactscope’s own blockchain on Avalanche. Sean explains the rationale, “Avalanche is one of the new so-called ‘Ethereum killers’, with much faster transaction times, lower fees, and it’s much more scalable. Our blockchain is capable of providing any kind of social enterprise with the tools it needs to tokenize and incentivize the positive impact of its operations. So we’re moving beyond just climate change.”

Gregg adds, “It doesn’t matter what sector you’re in, it doesn’t matter if you’re a social enterprise, a for-profit venture, an NGO… If your business is in delivering positive impact then we are building a blockchain for you, to give you the tools you need to build tokenomics models behind that positive impact.”

Doing the math

The Impactscope concepts started being developed around 2019, when there wasn’t a lot of reporting in the mainstream media about carbon emissions coming from the crypto sector. Currently carbon emissions directly linked to maintain the Bitcoin network are in excess of 90 megatons. That’s more than all of the emissions saved from electric vehicles in one year – or the equivalent of an extra 2.5 million diesel cars on our roads.

Sean gives a concrete example: “If I send you $20 from my Bitcoin wallet to your Bitcoin wallet – and by the way, the size of the transaction doesn’t matter here, whether it’s $20 million or $20, the carbon footprint of each individual on-chain transaction is identical. The carbon footprint of that $20 transaction is equivalent to watching YouTube videos non-stop for over 19 years, or making 2.3 million Visa transactions. This year alone, maintaining the Bitcoin network will consume close to 1% of global electricity. 7% of global electricity is all that’s required to service the entire financial services sector worldwide, plus all global government services.”

Waking up to the implications

Until recently the whole subject merited one or two mainstream media articles a month. Now it’s more like one or two mainstream articles an hour, with environmental impact becoming the most controversial aspect of the whole crypto space. As a result many individuals and organizations are now knocking on Impactscope’s door. With crypto markets running 24/7, the team is dealing with enquiries and clients on 4 continents, with agents in Hong Kong, North America and Europe.

Switzerland for legislation

Which takes us back to the Swiss dimension. Gregg says, “If you’re looking for the type of European jurisdiction at the center of blockchain and crypto innovation, in terms of legislation and the amount of companies, then Switzerland will be number one. Crypto Valley – of which we are members – is in the Zurich and Zug area. For us Geneva is the intersection for the sustainability side of our business. It’s the headquarters of several international organizations and Climate Change foundations, so it’s a natural home for companies working both on the sustainability side and the crypto side.”

The Balancing Act

Sean acknowledges Impactscope’s balancing act: “We don’t want to position ourselves as being anti-Bitcoin, anti-crypto, because first of all, that’s not true. We’re very cognizant of not positioning ourselves as preachy outsiders telling people what they should and shouldn’t be doing. Our mission is to solve a real problem in a commercial way, using market mechanisms. We want people to carbon offset by being more aware of the problem, and then taking action accordingly.”

The exploding Fintech scene

I return to Peach Zwyssig to hear more about what makes Switzerland so… well, Swiss. Sean mentioned Zug and the Crypto Valley Association, ‘Fostering growth, collaboration and integrity in the global blockchain economy.’ Peach confirms that something like 10% of the global-facing, European Fintech companies are in Switzerland, of which nearly half are in the Zurich area. This is in a country of a little under 9 million population, so Switzerland is supporting more than its share of activity, and being a ‘hot spot for innovation.’ There are around 400 Fintechs in the country, with the focus on payment, deposit lending, investment management, technology and medical applications, and the scene is ‘exploding’ according to the Axelra CEO. “Switzerland is a really interesting place to be if you want to talk about innovation,” he says.

Inside and outside Europe

And as to the subject of regulation, which across Europe is providing both difficulties and opportunities for Fintechs, Peach says that perhaps the hardest part is that the country is at the heart of the EU, but at the same time is like an island, not being an EU member. For example, “PSD2 is designed to connect everything with everything, but in Switzerland, we don’t have it at all. So if we do a Fintech integration, it’s super hard to do that with a bank – you almost die because there is nothing regulated! You have to build it from scratch. There are some integration layers coming, and about six or seven standards on the way, but no-one is really pushing hard enough, and it’s super slow. So all the Fintechs I personally know are having to do something by themselves.”

If a company needs PSD2, it has to do a double integration: Once for Switzerland, and once for Europe, and will probably start first in Switzerland. As a result of this extra mastery of the regulatory landscape, Peach says that, “The guys who really are making it in Switzerland, really know what they’re talking about. Then launching and scaling becomes super interesting.” For example, Inyova started in Switzerland and has now scaled to Germany.

Incidentally, Inyova is an impact investment platform looking to mitigate environmental damage, in a different but complementary way to Impactscope. As one of the principal investors in 2021’s CHF 11 million investment cycle for Inyova, Carole Ackermann commented: ‘Inyova strikes a chord, especially among the younger generation. Young people want to help shape a sustainable world but don’t want to miss out on a transparent and technologically state-of-the-art one.’

Style and ease of use

Sean Murphy sees this drive towards a sustainable world as growing ever stronger with offsetting becoming ‘almost ubiquitous’ in many digital and consumer services. He points to online banking apps, where around 15 European companies are known to be developing APIs for financial transaction offsetting. He’s particularly impressed by the Swedish Doconomy’s carbon linked credit card: “Instead of having a euro or krona spending limit per month, you have a kilograms of carbon spending limit per month. It tracks all of your purchases, and the associated carbon footprint of each item. When you hit your limit, it cuts off your card for that month and you can’t spend any more. It’s fantastic – sustainability plus digital services!”

I wonder how important UX-UI is to Sean, and Impactscope. The website is certainly very elegant and smooth, and he says, “Having in place a compelling, beautiful and intuitive user journey is a vital part of our business model. We attract the clients of cryptocurrency exchanges at the exact moment they’re making a cryptocurrency transaction. They’re either sending money to or from an exchange, buying or selling Bitcoin. Those are the main interfaces where we can capture that, and provide standalone carbon offsetting functionality for crypto transactions. These are busy people, so we want to make this a fast and seamless transaction, presenting the information and options in a very compelling way.” Hence the point of tokenizing the process via Avalanche. “I described Impactscope as a Sustainability Software as a Service company, but essentially, we’re a sustainability UX company, if you want to be even more precise about it,” Sean says.

The customer journey

And what’s the story with Axelra’s approach to UX? Peach Zwyssig describes customer journey workshops to analyze new customer journeys, although he observes wryly, “It doesn’t mean that everything they are telling you is correct… but it helps a lot.” How deep Axelra dives into UX and Testing is different for every client and Peach says it can be wrong to start with ‘the big vision’ if the funds aren’t there to explore and develop that. On the other hand he says that as Axelra has built many digital products, there is already a playbook of best practice which can be shown to clients.

The openness of the Axelra team’s approach is exemplified in the eNote Infrastructure of FQX which benefited from this. FQX is a blockchain based short-term financing & payment instrument for facilitating trade finance & money markets. Peach says: “We went to the Treasury Department of large corporations handling billions of dollars of cash, and you still need to think about the Treasury guy who’s going to issue an email and stuff for a process we would automate. This is quite an abstract thing for a developer. But we just brought our developers together with the end consumer, and they immediately started the paper prototyping at a very basic level. Then we went directly into sketch prototyping, and did some flows. The cool thing we have then is super enormous speed execution that we can really prototype. A couple of days later, we have it programmed and can roll it out to test it. So we have quick and iterative cycles, and our guys are just amazing at building and improving them.” Peach – as you may have noticed by now – is nothing if not enthusiastic about his company. He says there are 16 developers contracted to Axelra, along with a network of around 60 others. The ideal project team starts with 5 to 7 people, although some of the larger banking projects can have up to 80 people onboard. But even there, that core team of 5 to 7 people will still be around, “To work every day for many hours together and get it done.”

On a Swiss roll

In rounding out our time, I ask Peach for some recommendations to other Swiss Fintechs, and the suggestions come thick and fast. First up is Neon banking – ‘Easy, limitless, low-cost’ which at the time of our interview Peach says already has 60-70,000 customers from startup.

Selma he describes as into ‘financial literacy’ which claims to offer ‘Your finances done right.’ Inyova gets a mention for impact investment, and he recommends a look at FQX – which is ‘not that fancy, but super important to see.’

The Altoo Wealth Platform is also worth a look, especially for its ‘cool UI’. Relai – ‘Europe’s easiest Bitcoin investment app’ (according to the Relai website) also gets a tip of the hat from Peach. And then there’s SIBEX, founded on the talents of Guil Sperb Machado. Does Guil have any tips about exciting companies on the Swiss Fintech scene?

Squeezing worlds together

Well, I guess he’s careful not to mention names, perhaps as they’re already clients of AxLabs, or because the AxLabs team is doing that 3 months of study for a project. What he does comment on however is the mood of the Swiss scene. “In the past there was a lot of optimism and fireworks and flowers and champagne around, because blockchain was flourishing. Nowadays, it’s about consolidation as large companies in Switzerland are joining the game, and Switzerland is attracting a lot of people from outside to come here. These consolidated companies are meeting idealists like me, so now is the time to squeeze something out of this. It’s a process of squeezing both worlds together.”

Sean Murphy is also – typically it seems – global in his outlook. He spent many years as a partner in one of the first seed funds supporting emerging web and mobile entrepreneurs in Africa, and has done business on the ground in 10 African countries (and continues to do so with Impactscope). So perhaps unsurprisingly, when I ask him for ‘ones to watch’ – meaning in Switzerland – he points me instead in the direction of Wild Cards.

“It’s three young South African guys who use NFTs as digital representations of real animals, and they’ve built an animal conservation project around that. Some of the money from buying and selling the NFTs goes towards supporting the conservation of the real life animal. I think it’s an ingenious model. It makes sense, and is innovative and impactful.”

Last words

Did you expect to come across African wildlife NFTs in this dip into Swiss Fintech? I certainly didn’t.

And did I preface this piece by speaking of the possible dullness of Switzerland?

Here’s a final word from ‘energy bomb’ Peach Zwyssig: “After about 23 years of IT-services and consulting, I built up many companies, and now passing on that passion and experience to startups and seeing them growing people wise, and business wise, is so fulfilling. I really found out what I love doing, and I found a wonderful team who also share that passion, and love to get things done. It’s so fulfilling to work together with them and also see them growing. That’s beautiful.”

And Guil Sperb Machado? “People in the Fintech industry right now have a huge responsibility, not only in developing and delivering rock solid projects with innovation, but also in terms of education. Educating users, stakeholders, and government, showing how this powerful technology has the potential to completely reshape our society. As we move towards more disruptive technologies such as DeFi (Decentralized Finance), I feel a greater responsibility to do the right thing as well as educating others – this certainly maximizes the chances for broad societal adoption. That’s my message…”

And not a single mention of cuckoo clocks.

recommended

articles

Find out more about the topic

Share your opinion with us