How chatbots improve user experience in online banking

In the recent years, chatbots have evolved and improved significantly and penetrated areas where customer focus has a strategic importance, such as banking. In this article, we are going to present the main reasons behind the broader adoption of chatbot services from a customers’ as well as banks’ point of views.

Customer experience and chatbots

When we are talking about chatbots and customer experience throughout this article, we define things as follows. Customer experience includes all the activities that support the user while using a service or buying a product. Since the competition in banking is rising, especially with the development of online banks, it is beneficial for banks to turn towards a more customer-focused service in order to keep their current clients or even expand their client base.

A chatbot, on the other hand, is a technology based on artificial intelligence designed to simulate a conversation with the user through text messages offering an active service.

Different levels of customer support and ways of implementation

We can outline different chatbot’s categories based on scopes and methods of implementation.

Some chatbots are implemented within a bank app; others into an instant messaging service like Facebook Messenger. Messenger as a platform for chatbots can be more comfortable for users than a native banking app, as people are familiar with Messenger, they generally use it on a daily basis and they know how to interact with its interface.

I would quote a famous quote “meet your audience where they are”, we can say instead “meet your customers where they are ”.

Chatbots may also differ in the level of support they aim for. Some chatbots provide basic assistance by giving information about certain topics but not helping with more complex issues. Others carry out real actions such as transactions, payments, checking balance or even getting loans. Furthermore, there are chatbots that not only support your banking activities but also let you manage external operations such as paying your bills, booking and paying tickets, managing your budget, etc.

How chatbots improve customer experience

24/7 digital support

The advantage of a chatbot is to provide active support all the time. “A person needs breaks, but a robot can work forever.” The act of contacting the customer support in itself may reflect limitations in the application’s information architecture and from users’ point of view it produces stress, dissatisfaction and a waste of time (this happens in the 65% of customer journeys). Therefore, it is necessary that customer support design is filling this gap in the most effective and fastest way possible.

Speed and feedback

Studies show that people find phone calls boring and slow compared to instant chats. Customers are looking for speed and feedback. Essentially, when a users contact customer service they are unable to estimate the time needed to resolve their problems. By using chatbots, waiting time is shrinking to zero or if human assistance is needed, you can give feedback to your clients about the current status of their case.

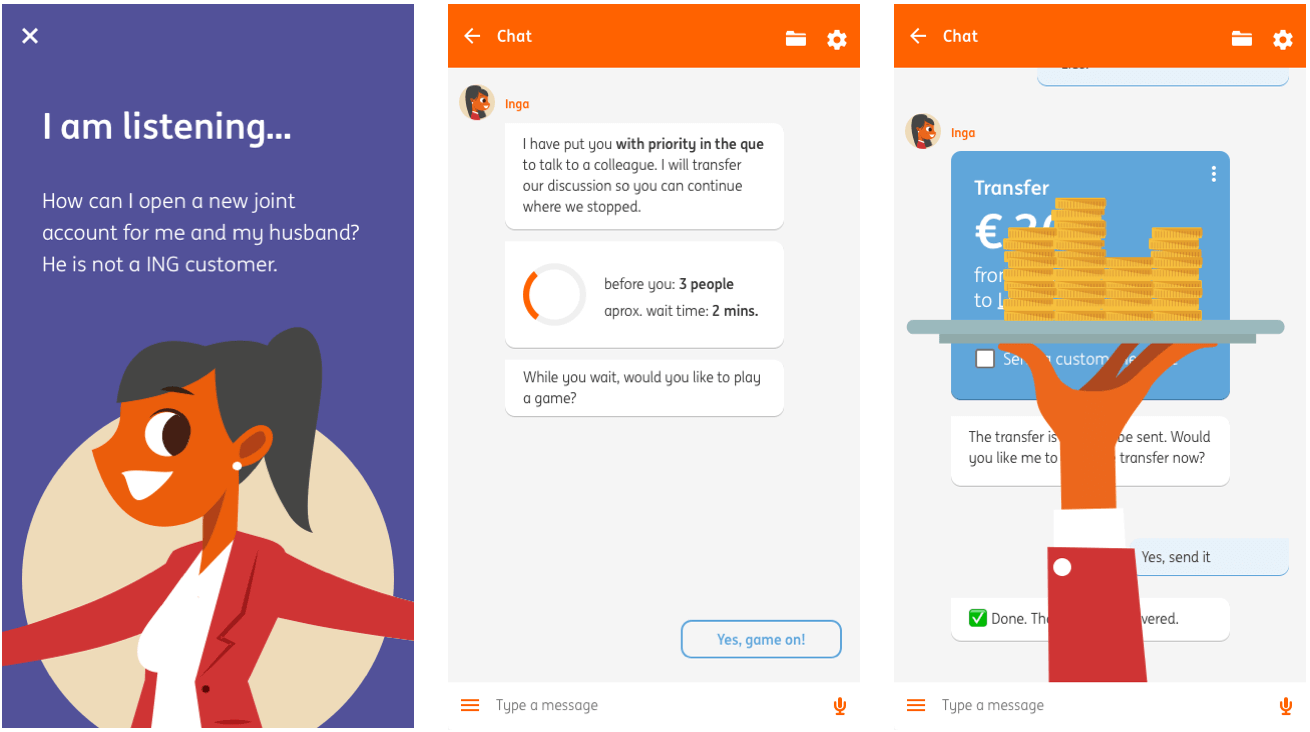

Inga, the ING Bank’s chatbot was designed (to the last detail) to make the service as customer-focused and user-friendly as possible. Inga provides precise feedback on waiting times and how many people are before you in the queue. Moreover, it even gives you the opportunity to play games while waiting for your turn.

Not only efficient but also funny!

Always learning and evolving

AI is a constantly evolving technology that can efficiently use big data and the information from huge datasets to solve problems by finding patterns which humans wouldn’t be capable of. With time and by collecting more and more data about your clients’ problems your chatbot is going to learn to anticipate customers’ problems and better serve their needs by giving them relevant answers and solutions.

What proportion of banks use chatbots

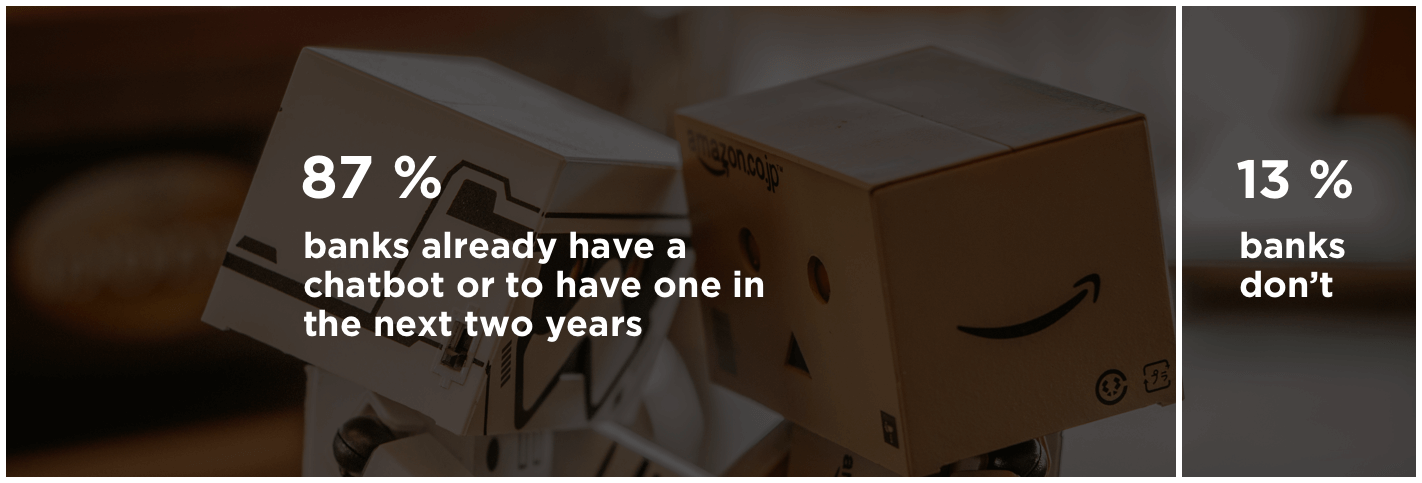

Since the first financial chatbots were implemented, an exponential growth has happened in the number of companies employing them actively. Based on a Personetics survey, 87% of banks already have a chatbot or they plan to have one in the next 2 years.

Breaking down the 87%:

- 15% already have a chatbot

- 31% have an ongoing chatbot project

- 26% plan to have one in the next year

- 15% expect to have one in 2-3 years

Only 13% of the surveyed banks do not have a chatbot strategy at all.

What does a good chatbot look like – let’s see some examples

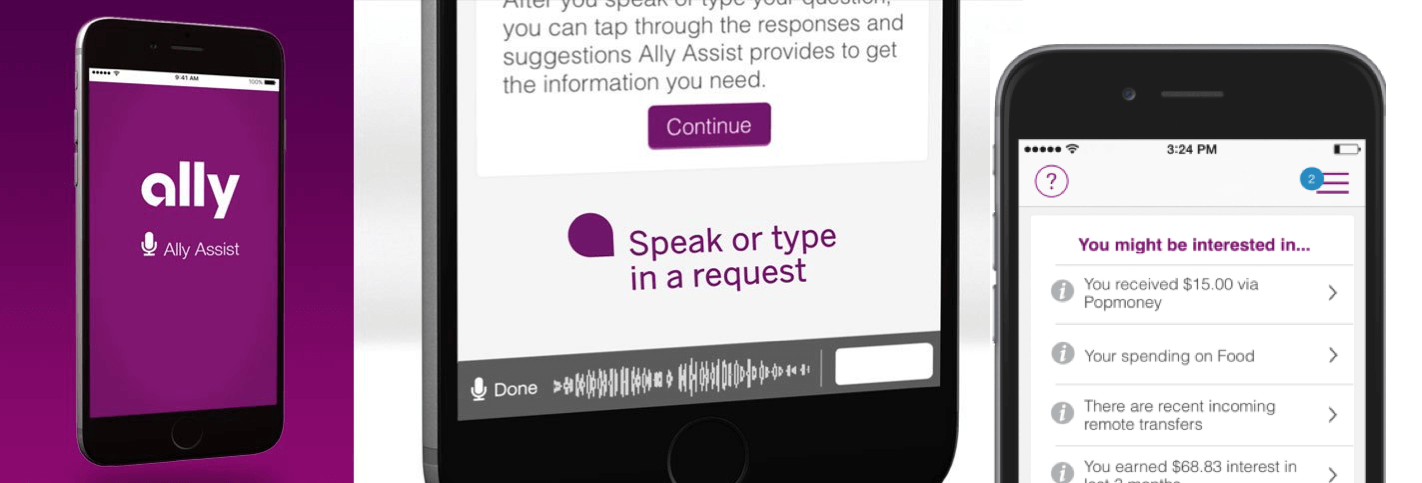

Ally from Ally Bank

Ally, the virtual assistant of Ally Bank, is available from the app’s menu. Users can interact with Ally in spoken words or written messages. The chatbot is designed to help you manage your finances by performing calculations such as giving an overview of your expenses or checking the balance of multiple accounts. Using artificial intelligence and customer data profiles, Ally learns from user interactions and transactional behavior in order to give faster and more personalized support.

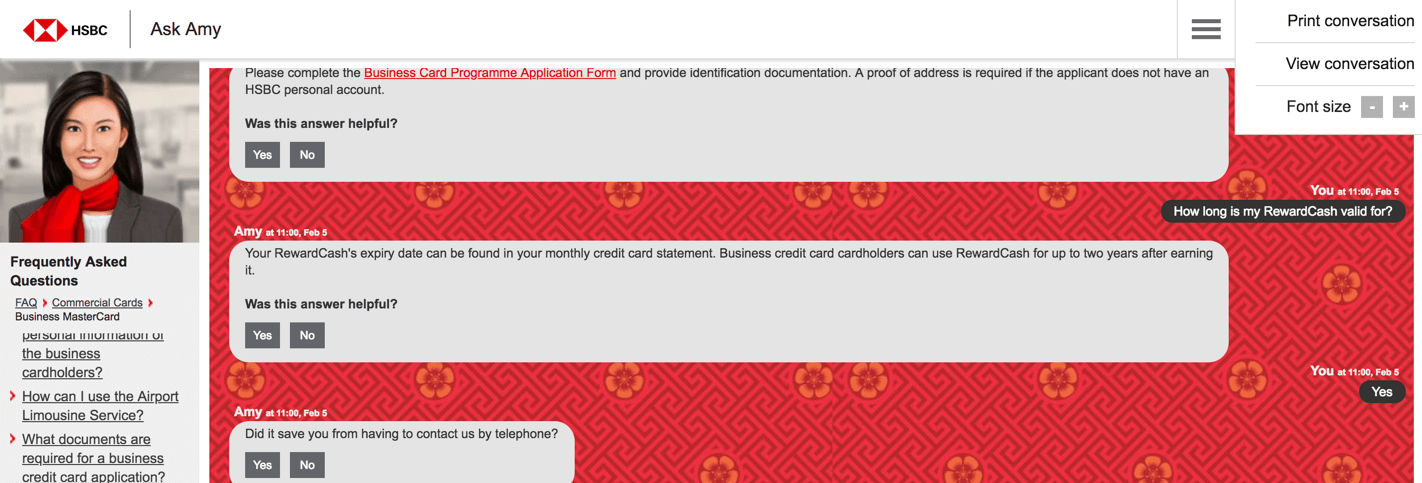

Amy from HSBC Hong Kong

Amy is the virtual assistant of the Hong Kong branch of HSBC bank. Amy runs on both desktop and mobile platforms. The users can personalize the interface by changing the view mode or the font size and if needed they can print out the conversation.

Eva from India’s HDFC Bank

Eva, the chatbot of HDFC Bank of India, integrates to all digital channels of HDFC Bank. It also runs on Facebook Messenger and the user can start the conversation just by opening the chat. Moreover, it is also available via Google Assistant; just say “Ok Google, talk to HDFC Bank” to start to interact with Eva. She can help you not only in managing your finances but also in purchasing tickets for different kinds of events such as cinema or concerts and soon even for booking flights or hotel rooms.

So Eva is really a fast handyman!

Pay electricity bill through HDFC’s chatbot

Why should a bank implement a chatbot?

With more and more online banks and other modern financial solutions, traditional banks are facing a competition they have never experienced before. Consequently, they are forced to keep up with these innovative solutions in providing a top level customer experience in order to keep their clients and acquire new ones.

Research has shown that the cost of a human customer service employee goes from $5 to $35 per call while web chats cost about $3 per interaction. Chatbots on the other hand that utilize AI technologies cost less than $0.50 per interaction. This is because it is cheap to implement, and though you can build your own platform, you can already use existing ones such as Facebook Messenger. On the other hand, you don’t need as many employees as before to keep the same level of quality in your service. With one chatbot you can serve millions of customers at once even in extreme hours as late nights or early mornings. This can substantially lower the load on your customer service and free up human capacities that can be redistributed on cases that are more complex and therefore need human intervention.

Therefore the application of chatbots allows banks to save money and at the same time offers a faster and more efficient service 24/7.

Conclusion

We can therefore say that chatbots are and will be increasingly pioneers in the digital transformation of banks as well as in the construction of a customer experience’s model.

The introduction of this technology has brought different benefits from user-side as well as bank’s-side. The chance to receive quick responses with an active 24/7 service enhances the clients support bringing satisfaction to current clients and increase the chances to get new ones. On the other hand, we see how banks can improve and innovate the customer experience at limited costs through chatbots usage that even allow them to save on staff.

Obviously, to make the difference and have a unique product what you need is a good UX Team;)

recommended

articles

Find out more about the topic

Share your opinion with us