At war – Ukrainian Fintech and banking

There are several vectors I’m dealing with here, as I start to write up an interview with Mariam Matiashvili, Chief Business Development Officer of the Ukrainian payments company LEO. The previous night I was at a concert by the Ukrainian band DakhaBrakha that I’ve been a fan of for several years, now on a tour of European capital cities, spreading the message about the invasion of their country, and raising funds and consciousness. It was a powerful performance, with shocking video images of the colossal destruction being done.

Another vector is that the same day I met up with a Colombian acquaintance, visiting Europe for the first time, who repeated the viewpoint that is apparently widespread in his country, about the Russian invasion of Ukraine. “It’s all the fault of NATO,” Roberto explained. “They pushed Putin into the invasion. We see it on our news all the time, that Russia didn’t want war, but they had no choice because of Ukrainian and NATO aggression.”

I have to say that my mouth was hanging open in shock at his reading of the history which we are tied up in right now, but to preserve our own little bit of peace, I settled on telling Roberto the story as I believe it to be true.

Then there’s the vector of the job in hand, which is to interview Mariam about the growth and development of LEO, as one of the leading Fintech players in Ukraine. The company describes itself as ‘A payment processing company. We provide payments between merchants and developers in 9 CIS (Commonwealth of Independent States), EU, and Asian countries, discovering new markets and running your business with great success. We are focused on online game monetization and always looking for new partners to work with.’ LEO offers:

- Reliable processing

- 100,000 payment terminals

- Immediate enrolment

- Loyal customer support

Mutual opportunities, gone…

OK, all good, but how can we talk about all that without speaking of the war, and the response from people outside Ukraine? Later, some way into our interview, I ask Mariam how she feels about western Europe’s somewhat delayed awakening to the threat from Russia. After all, Ukrainian territory was invaded in 2014. Many countries had been talking about the conflict since 2014, but it was not a daily topic of discussion or a common problem until it escalated into a full-scale war throughout independent Ukraine. So to some extent the build-up of forces at the Ukrainian borders caused concern in many countries, and they began to talk about it, but everyone hoped that the war would not start, and that the problem would somehow disappear. Since 2014 however Mariam does note that the relationship between the people of Russia and Ukraine, and business connections, had already deteriorated badly. Before that there were good opportunities from a mutually large market for goods and services, which economically speaking is now non-existent, as Russian aggression has left no choice for Ukrainian people and businesses. Mariam herself was born in Moscow and lived there for seven years, so she speaks from a knowledge and understanding of the situation in both countries.

Searching for safety in crisis

But let’s rewind to the start of our meeting. I was half expecting to be speaking online to someone in a cellar, lit by emergency lighting and running on battery power. It’s the time of huge blackouts across Ukraine with the country’s electricity grid being targeted daily. Instead Mariam appears in a well lit modern office, with tall business buildings reflected in the windows. That’s because she’s in Warsaw, and has been away from her home since February 14th when she fled with her baby, although her husband is still in Ukraine and not allowed to leave. She expected to be gone for only a short while, but at the start of the invasion on February 24th, LEO’s CEO Alyona Shevtsova called her to say, ‘Stay away’. With the lives of employees being the most important thing, Alyona and colleagues started developing crisis plans to move the company’s Kyiv offices to Lviv, where there was already one office. However safety wasn’t to be found in Lviv either, so over time many of the female employees, especially those with children, were moved to the newly established office in Poland, leaving the all male IT department in Ukraine.

That was then, this is now, as the Warsaw office has been gradually de-staffed and re-re-located to Kyiv, leaving Mariam and only about ten colleagues to keep things running – and even expanding into new markets.

How is it seeking refuge in a country which Mariam had never previously visited? She’s full of praise for the way Polish people have welcomed Ukrainians during the crisis and helped them integrate, and points out that the similarity of the two languages has helped. I’m also surprised to hear the degree to which, in less than a year, Ukrainian businesses have established themselves in Poland. Life goes on, and there are now Ukrainian beauty salons, gyms and restaurants in Warsaw. There are also trials of a new service from LEO, but we’ll come to that.

Sector growth, and more growth

Let’s start from the start, with a little history of the LEO international payments system. Alyona Shevtsova began her career with a legal company supporting payments companies and Fintechs. This led organically to being the official payments representative in Ukraine for popular game developers such as Wargaming, and Riot Games, and by 2017, ‘Every seventh person in Ukraine had an online games account.’ LEO grew rapidly, and as Mariam says, “Provided services to its partners – initially with a terminal network which grew to 45,000 cash machines, a big part of all payments being made through these terminals. We also provided online games with our partners who were like aggregators, with different services. And then we decided to make our own payment solution and provide it to our partners, to those developers with online games on their websites. In other words, our own gateway.” Part of this solution was to become a shareholder in IBOX Bank, founded in 1993. The resulting success of the LEO strategy is that even now during the war, the company is the third largest in terms of the amount of transactions processed, according to statistics from NBU, the National Bank. The Fintech Novapay is number one, followed by Ukrposhta, the national postal service.

Payment systems and solutions

Leo became a payment system by building its own ecosystem for financial market participants, both residents and non-residents of Ukraine. All these participants have the opportunity to provide each other with their services without signing additional agreements. “It’s really fast and comfortable for us and our partners, because they can take on new services inside IPS LEO.” So LEO – as the original company was called – was never about creating games as such? No, says Mariam, the company has partners who develop games, and as an official representative of those developers provides these services for Ukrainian users, along with technical support as well. LEO has always been a Ukrainian company, with a lot of partners in the CIS and EU.

And has Mariam been a key part in the growth of LEO? Well, yes and no. Certainly since she joined the company in 2019, having graduated in Economic Relations and decided that whatever she was going to do as a career it would not be in the financial sector, which she thought was definitely not something she would be interested in. It was Mariam’s “First proper job,” but she wasn’t immediately convinced, and spent several months thinking that it wasn’t for her. Then things ramped up and it became really interesting: “Every day there’s something new, new projects, experiences, new partners and fields, and it’s really cool. So I’m in love with my work.”

The first plan – peace and security

New projects? Future plans? “The first plan is to finish this war,” Mariam responds immediately. Her gut feeling, and that of many acquaintances, is that it could drag on for up to another year, but her certainty in the ultimate success of Ukraine is clear (an opinion shared vocally by the band DakhaBrakha). And then ten years to repair and rebuild? Mariam is more optimistic on this front and hopes for five years to get the country somewhat back on its feet. “Why am I so confident in the rapid recovery of Ukraine? Because Ukrainians are special. People who work 24/7 to help each other, and this is definitely the key to success. Of course, this will come with the help of massive foreign inward investment in infrastructure and businesses – a chance to renew and remodel the whole economy.” Revolut and Wise already established services in 2022, helping Ukrainians have easier access to European banking services.

The Diia solution (‘Diia’ means ‘Action’) is a mobile app, web portal and e-governance brand launched in 2020, to help Ukrainians with digital documents for ID and sharing. The portal gives access to more than 50 government services, and was originally developed to respond to the pandemic. Speaking at the Amsterdam Banking Forum in November 2022, Mariam was surprised to find that attendees from other countries didn’t have anything as comprehensive as Diia – until it was pointed out that PSD2 in Europe makes for many more regulatory restrictions than are currently at play in Ukraine.

She also mentions the Revolut-like Monobank, ‘The first mobile-only bank in Ukraine’ which acquired its first million active users in just 18 months. In comparison, Revolut gained two million users in the same period, but across the whole of Europe. “The Ukrainian market is new, and our users really accept new technologies. For example, with Apple and Google payment methods, Ukraine was one of the first countries to adopt these solutions. And we had mobile payments in our Metro stations four years before New York! Ukraine is not yet a well known market, but our Fintech companies are several steps ahead of many European companies.”

The Fintech sector is still at 100% – almost

I remark that the National Bank of Ukraine appears to have been very effective since the invasion – is that Mariam’s experience? “At the moment the Ukrainian financial system is working normally and we don’t have any problems with bank settlements. For sure we have restrictions as a company because at the moment we can’t send money outside of Ukraine. And as individual users we can spend approximately €2,400 a month from our cards outside of Ukraine. But the National Bank has provided a lot of solutions which have allowed us to continue working. Before the war, all Ukrainian financial companies and banks needed to have all their servers inside the country. Now the bank has allowed us to take them out and use cloud solutions. That’s a big, really good solution for the whole Ukrainian financial sector.” The Central Bank responded quickly because there was little choice but to take measures to support the economy, and Fintechs in particular. With agriculture hugely damaged, and a lot of industry unable to produce, Fintech is one area which is still functioning to keep the wheels on, and turning. “For the moment,” says Mariam, “We are practically one of the only sectors which can still work near to 100%.”

Electricity and telecoms

How do you keep going though, when offices and personnel are scattered, when electricity cuts are increasing, and communication systems are down a lot of the time? And this is not even to factor in the human emotions of fear, discomfort, and the loneliness and insecurity of families torn apart. The answer for LEO was that as well as shuffling offices to Lviv, then back to Kyiv, and onwards to Warsaw, diesel generators were acquired for all in-country locations. Solar paneling is also currently being considered, although this isn’t going to be much help during the winter. Then there’s Elon Musk…

Now if my Colombian friend Roberto can be mis-directed by his news services, I guess so can I be by mine, having absorbed the PR messaging that Musk’s Starlink broadband-via-satellite service has been provided free to Ukraine. Well, er, not quite. Mariam corrects the picture, saying that Starlink is free to the Ukrainian military, and has proved hugely valuable. But for everyone else? It’s sign up for the service, which provides a lifeline for businesses and individuals alike. “It’s a really good business solution and the business model is good,” but Mariam says that the demand is huge, and the cost of subscription can be more expensive than the usual Internet providers. However with mobile networks being down much of the time, Starlink provides the only reliable way of continuing to stay in touch, both for families, and for businesses and their customers. WFH – Working From Home, which grew so strongly during the pandemic – is less of an option in Ukraine, as people often have no power or heating in their own houses. This is why the nearly 400 employees of IBOX, and 150 employees of LEO still need offices to work from, equipped with whatever emergency generation facilities and satellite connections that can be supplied.

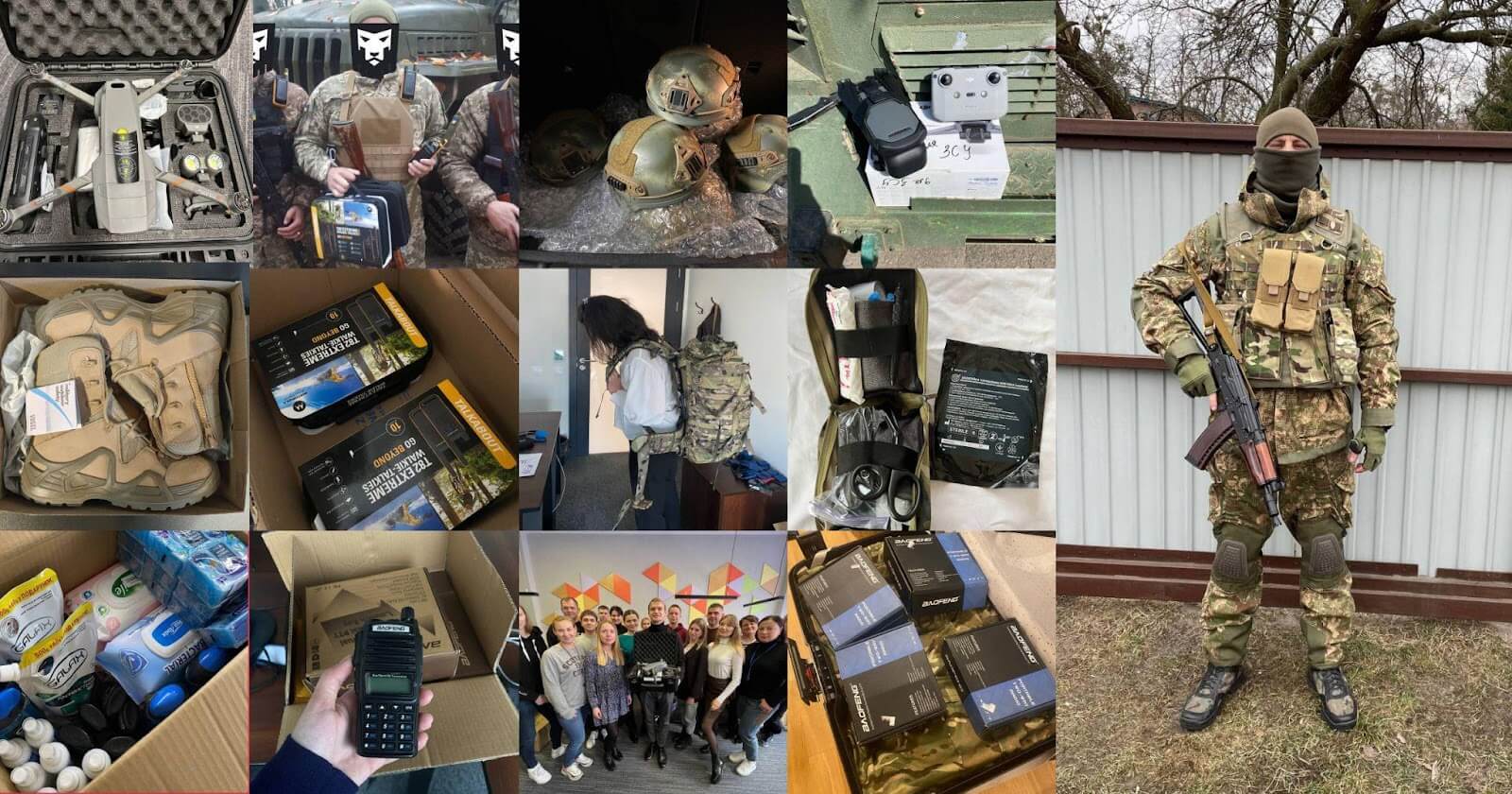

Supporting colleagues at the front

While this puts everyone on a war footing to some degree, there are also company employees who are now actively at the front with the armed forces, which Mariam describes as, “An honor.” Leo supports them with uniforms and protective clothing, including body armor, and sometimes drones. The company also donated eleven armored bank cars to assist in the evacuation of people from Kyiv region, with three vehicles being destroyed in bombing, but thankfully with no loss of life. It once again forcefully reminds me of how extraordinary the whole situation is – even this interview with Mariam. Here are Fintech and other companies continuing to do business – despite cyber attacks – while employees go to war, and missiles rain down randomly across the country. Not for the first time in this maddest of mad years, I feel my emotions welling up, but fortunately András Rung of Ergomania has joined the call and pitches in with some UX-related questions. Like, when time and money are at a premium, is UX currently seen as a luxury by Ukrainian businesses?

The somewhat luxury

Mariam considers this and agrees that presently UX is a luxury, somewhat. But with increasing online banking and use of e-wallets, the conversion of payments relies on smooth processes. Users expect one-click solutions, and ‘instant’ understanding of how to use an app or process. So the demand for good UX is there, but… it’s expensive.

András draws on his own experience of visits to Ukraine, and observes the high levels of mobile use he noticed, especially among younger people, ‘But even,’ he says, ‘among older people too.’ So is mobile important to financial services? Mariam has already mentioned Monobank, which is exclusively mobile, with a rapid uptake of users. “People don’t want to use the web version from banks or other services. It’s more convenient to pay by phone, or with their smart watches.” Currently around 40% of payments are made using NFC (Near Field Communication) solutions, and Mariam can only see this as growing.

Is cash king?

András next wants to know about cash and its current place in the Ukrainian economy. As more and more people use mobile services, does that mean cash is becoming less important? Mariam’s answer is that Yes, this is the case, but probably only in the short term. She describes how in the early months of the invasion many businesses such as hotels and gas stations were unwilling to accept credit and bank cards, because no-one was sure whether the banking system would hold up. Then the National Bank enabled withdrawals of cash in pharmacies, shops and gas stations while buying petrol, food and other staple goods. Before the war roughly 20% of payments were made in cash, a figure that Mariam says has risen since. Will cash remain important? She predicts that after the conflict, and as Ukraine likely becomes more integrated into European financial systems, cash usage may decrease again.

Integrating with Europe

This integration with Europe is part of a future scenario which Mariam sees for after the war, with adoption of PSD2, and entry into the SEPA zone (Single Euro Payments Area). And does that mean growth opportunities for Ukrainian Fintechs? Integrating with Europe will require a lot of work for the Fintechs, Mariam says. There will be many opportunities, and UX will play an important part in merging what are currently very different markets. “And maybe Europe will also take some points from Ukrainian products and Ukrainian services.”

So a two way street of mutual learning which will be of benefit to Ukrainian Fintechs, and those in Europe. In the meantime, András points out that many Fintech people, designers and UX-ers have already left Ukraine, and are working in other countries, so will they ever return? An impossible question to answer, but Mariam’s own take on that is clear: She’s been made welcome in Poland, but her heart is in Ukraine, and that’s where she’ll return at the earliest, and safest, opportunity. Only time will tell how many of her far-flung colleagues and friends will also go back to rebuild their country.

New systems, new initiatives

In the meantime, there are developments in her host country, as the newly-registered IboxPay rolls out cash terminals in shops, mainly as a trial service for the many Ukrainians now living in Poland. Then there’s expansion into the UK too, with new online payment solutions – a development which only began after the start of the war. It seems amazing to me that in a year when merely surviving has been the main issue for Ukrainian companies, LEO has also been expanding into new territories. “We have this group of companies and the bank, and now we will also add European financial companies to the structure to develop in synergy,” Mariam explains. She makes it sound quite logical, and even easy, but she has also described how everything halted in the early days of the war. “At first we suspended the flow of operations, because we didn’t understand what rules the National Bank would establish, and what would be the new, military working conditions.” The regulator quite rapidly clarified the situation however, and then Leo had to get very busy reviewing and changing huge amounts of processes, much of which had to be achieved with patchy internet communication. But now everything is functioning well? Mariam’s expression tells the tale: “Yes, everything is working fine, when there is electricity, when there is internet connection. The network of cash terminals are also vulnerable, because these of course rely on electricity, which now may be provided by generators, but which are very difficult to buy in Ukraine right now.”

At the time of our conversation, with blackouts across the country, 80% of terminals were temporarily down, a dropout which lasted no more than one day, with 24/7 working to rapidly restore and ensure operation. And despite all this, during 2022 LEO actually increased payment volumes by 6%, according to the National Bank.

To discuss the growth of Fintech in Ukraine, and the specific plans of LEO is impossible without reference to the war, which has run through the whole discussion with Mariam Matiashvili. How can it not? The war is having impacts across Europe, and around the world, but for people in Ukraine the many consequences are of course hugely magnified. The fact that businesses survive at all is a mark of their resilience and ingenuity in facing incredible difficulties. And the fact that a major Fintech such as LEO has actually grown seems something of a miracle, steered by a team spread out across temporary offices, working together to keep the wheels on… and turning.

recommended

articles

Find out more about the topic

Share your opinion with us